Retirement withdrawal calculator with inflation

The withdrawal amount will be significantly higher if the assumptions are changed in the case for example of a higher inflation rate. There are two sides to the retirement planning equation saving and spending.

Retirement Withdrawal Calculator For Excel

The AARP Retirement Calculator will help you find the best amount to save to reach your goal.

. However future withdrawal amounts will largely depend on whether your investments meet your long-term growth. However depending on the rate you can earn and inflation you still may not have enough money to last through your retirement. Over the last 40 years highest CPI recorded was 135 in 1980.

Savings retirement investing mortgage tax credit affordability. You think you can earn 5 per year in retirement and assume inflation will average 35 per year. Free fast and easy to use online.

Subsequent withdrawals will be more than the interest earned to compensate for inflation. This is an important part of any retirement planning calculation. It also provides you with a recommendation for additional savings if your projected funds fall short.

A common measure of inflation in the US. Withdrawal Rules Roth IRA Roth IRA Account What is a Roth IRA. Increase for your income This is the percentage of additional income you think you will need each year based on inflation an economic measure of increasing prices for goods and services.

The inflation rate in the US. Retirement Withdrawal Calculator Insights. In most circumstances this would be the best method to use of the three.

Tack on an additional 2 to adjust for inflation. The formers contributions go in pre-tax usually taken from gross pay very similar to 401ks but are taxed upon withdrawal. Are you getting ready to retire or within 5 years of retirement.

Social Security benefits are adjusted annually for inflation. The above table will likely show you need to work slightly longer because your withdrawal rate should be less than your return on investments. How much can I afford to.

Weve planned it such that your overall income over time will increase at rate of inflation of 2. On the verge of retirement. The initial withdrawal will be adjusted for inflation based on the number of years until your retirement.

You decide to increase your annual. The calculator takes into account your registered and non-registered savings annual returns investment fees income tax. Individual 401k Contribution Comparison.

Growth rates are - low. Department of Labor the average inflation rate was 18. Our Retirement Calculator can help by considering inflation in several calculations.

Assumptions and Limitations of the Personal Retirement Calculator. These are the required assumptions and every calculator must have these inputs. This easy-to-use calculator makes retirement planning a breeze.

This is what you expect for the average long-term inflation rate. The asset accumulation phase saving leads up to your retirement date followed by the decumulation phase where you spend down those assets to support living expenses in retirement. Our retirement savings calculator will give you an estimate of how much you need to retire and how much you have saved already.

If you are getting Social Security benefits before. Annual return on investment is after taxes and inflation. Our Retirement Savings Calculator is designed to help you evaluate whether or not your current retirement savings are sufficient to generate the inflation-adjusted retirement income you need to last the full duration of your retirement.

Impact of Inflation on Retirement Savings. - Create a monthly or annual payout schedule. All retirement calculators require the same basic inputs to work their magic your retirement age life expectancy inflation investment return portfolio size and expected retirement expenses.

Retirement Withdrawal Calculator - If youre already retired or close to retirement calculate how much you can withdraw from your savings to last through retirement. According to the US. Use this calculator to see how long your retirement savings will last based on your retirement savings and your inflation adjusted withdrawals.

Use our free retirement withdrawal calculator to evaluate your plan. The second year. In contrast Roth IRA contributions are deposited using after-tax dollars and are.

You are more likely to make monthly. Hopefully this retirement age calculator gives you insights into your retirement options. And withdrawal rate first row.

Use this calculator to determine your 2022 maximum Individual 401k contribution as compared to three other possible plan options. Show assumptions Avg Household Savings Rates 2008 Sources. At the time of retirement this will provide a pre-tax income of which may increase at the rate of inflation throughout retirement.

College Savings Calculator 529 Savings Plan Overview 529 State Tax Calculator Learning Quest 529 Plan. We arrived at as your desired pre-tax retirement income because you indicated you wanted a post-tax income of 50000 adjusted at a 2 rate of inflation for when you retire at years old. A 100 withdrawal will leave you with 70 after taxes.

If you want to spend 100K a year during retirement plan to save somewhere between 25M to 333M in order to retire. - Enter an annual inflation rate to automatically increase the amount withdrawn each period. Retirement Budget Calculator can help you estimate your budget life expectancy net worth taxes withdrawal strategies Roth conversions and ultimately answer the question.

For example if you have 1 million saved under this strategy you would withdraw 40000 during your first year in retirement. Head over to our Ultimate Retirement Calculator to get an idea of how much you should start saving. Learn about the different strategies to help create a plan to fund your life in retirement.

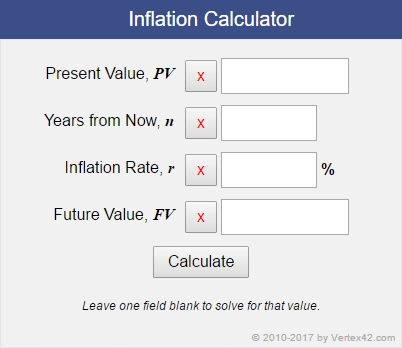

This calculator makes assumptions. This withdrawal amount is inflation-adjusted assuming a default rate of 217 or your selected percentage. You wanna calculate something.

Thats a big plus and one that makes waiting to collect worthwhile. Retirement withdrawal strategies vary for each person. Is the Consumer Price Index CPI.

Did go up quite a bit in the 1980s as a. It is not a calculation of your personal tax liability. A retirement calculator better than Vanguard and Dave Ramsey.

An exception to this will be if you enter a value for Annual inflation rate then only the first withdrawal will equal the interest earned for the year. Take a percentage of the initial balance then adjust that annually for inflation. 1 to 100.

From 1925 through 2017 the CPI has a long-term average of 29 annually. The real rate of inflation could be lower or higher than this. But so far inflation has held steady at below 3.

We break down which retirement accountsIRAs or 401ksmay be right for you. Enter your account balance-Your interest rate. The tax figure shown is a calculation of the tax that would be due on the cash withdrawal based on our assumptions.

5 Early Retirement Calculators For Your Journey To Fi Choosefi

Retirement Savings Calculator

Retirement Family Finance Planner Workbook Budget Monthly Etsy Family Finance Finance Planner Money Organization

Free Retirement Planning Calculators Money Tip Central

Inflation Calculator For Future Retirement Planning

Annuity Calculator For Excel Annuity Calculator Annuity Calculator

Retirement Age Calculator With Printable Schedule Chart

The Best Retirement Planning Calculator Comprehensive Features To Help You Plan For Your Future Retirement Budget Calculator

Retirement Calculator

Retirement Calculators

Firecalc Why Another Retirement Calculator

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Retirement Withdrawal Calculator

Retirement Withdrawal Rate Calculator Financial Calculators Retirement Calculator Retirement Portfolio

Will You Have Enough To Retire The 4 Rule May Help Within Limits

Fire Calculator When Can I Retire Early Engaging Data

Retirement Calculator Spreadsheet Retirement Calculator Budget Template Simple Budget Template